RBI Monetary Policy: MPC Keeps Repo Rate Unchanged at 6.5% for the Fourth Time

In a significant move to maintain economic stability, the Reserve Bank of India’s RBI Monetary Policy Committee (MPC) has decided unanimously to keep the policy repo rate unchanged at 6.5%. This decision marks the fourth consecutive time the committee has chosen to maintain the benchmark repo rate.

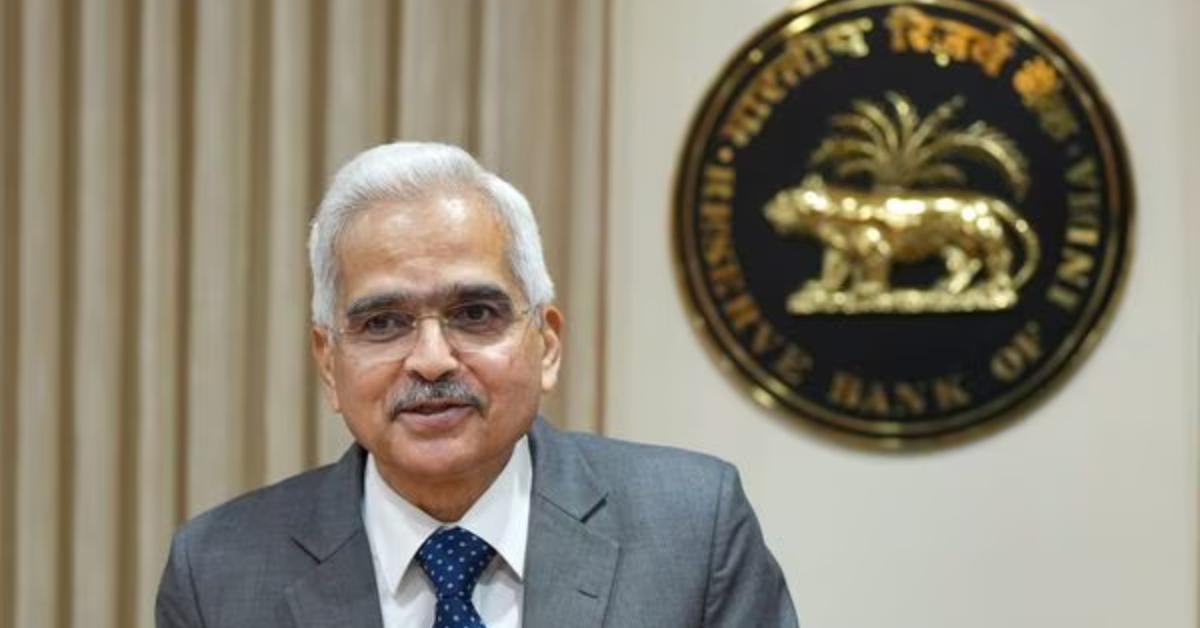

Governor Shaktikanta Das, while announcing the policy decision, emphasized the importance of macroeconomic stability and inclusive growth as the foundation of India’s progress. He stated, “The policy mix that we have pursued during recent years of multiple and unparalleled shocks has fostered macroeconomic and financial stability.”

Das also highlighted a notable transformation, saying, “The twin balance sheet stress that was encountered a decade ago has now been replaced by a twin balance sheet advantage with healthier balance sheets of both banks and corporates.”

This steadfast stance on interest rates comes after the MPC raised the repo rate by 250 basis points from May last year until April 2023. The central bank’s committee, with a majority vote of 5:1, has decided to maintain its withdrawal of accommodation stance to ensure that retail inflation remains within the target of 4 percent.

The RBI has a mandate from the central government to maintain consumer price index (CPI)–based inflation at 4 percent, with a margin of 2 percent on either side. While India’s retail inflation in August eased to 6.83 percent from a 15-month high of 7.44 percent in July, it continues to remain above the upper limit of RBI’s tolerance band for the fourth time this year and the seventh such instance since August 2022.

Governor Das offered insights into future projections, stating that retail inflation in September is likely to ease. However, concerns arise with a fall in kharif sowing, potentially posing a threat to this trajectory.

For the fiscal year 2023-24, RBI has retained its CPI-based inflation forecast at 5.4 percent. In specific quarterly forecasts, Q2FY24 has been raised from 6.2 percent to 6.4 percent, while Q3 is expected to be at 5.6 percent, reduced from the previous estimate of 5.7 percent. For Q4, the projection remains steady at 5.2 percent. Looking ahead to Q1FY25, RBI maintains the inflation projection at 5.2 percent.

The MPC’s decision reflects a commitment to balance economic growth with inflation control, aiming to steer India’s economy towards continued stability and progress.